Revenue-based

Financing

Revenue based financing

Flexible repayment

E-payment integration

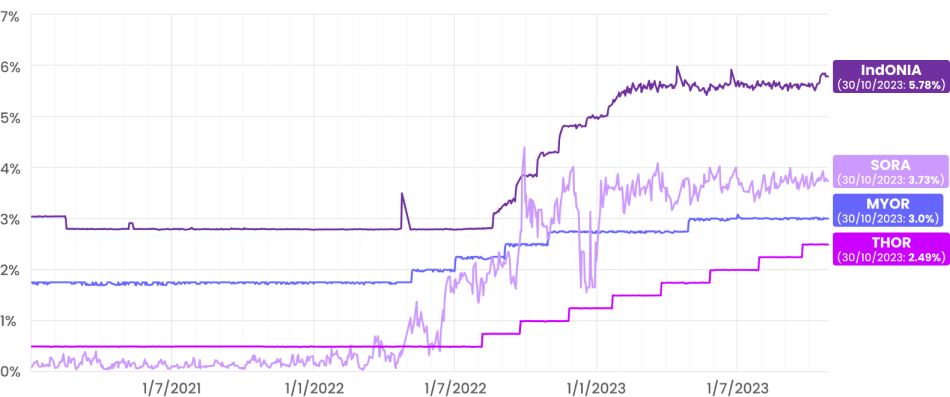

Implication of rate hikes

1. Interest payments increase.

2. Rate hikes are to combat inflation, which means higher operating costs.

Difficult to survive

1. Net cash flow drops.

2. MSMEs are difficult to fulfill repayment obligation.

3. Banks liquidate MSMEs.

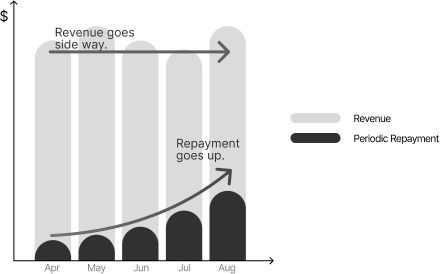

Intensifying cash flow burden

1. Inflation is not fully passed through to customers.

2. Higher costs and interest payments squeeze down margin.

Implication of rate hikes

Inflation means higher operating costs, which cannot be fully passed through to customers. This squeezes down margin.

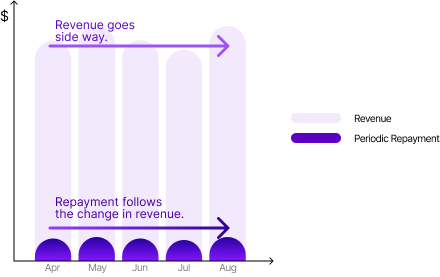

Easing cash flow burden

1. Unlike fixed-income instrument which ties interest payment with reference rate, repayment is a predetermined % of revenue.

2. Therefore, repayment of RBF will not intensify cash flow burden even when reference rate goes up.

Higher chance to stay

1. MSMEs may suffer from losses for a period of time.

2. But it will not face immediate repayment demand and threats of liquidation.

Upward drifting Domestic Reference Rate